Knowing all the financial vehicles to improve the cash flow of your business is critical for success.

The market conditions today are rapidly changing, and you need to know how to adapt to them to remain competitive. That’s particularly important when your business is growing or struggling with unstable cash flow.

These are the times when you need to know how to get an unsecured business loan. But keep in mind that not all unsecured business loans are created equal. Understanding how a business loan works is essential: typically, you receive a lump sum upfront for a specific purpose and repay it over time, which differs from a line of credit where you can draw funds as needed.

This article explores what the business line of credit is and what makes it one of the best unsecured business loans and small business line options to improve your cash flow.

What Is the Business Line of Credit?

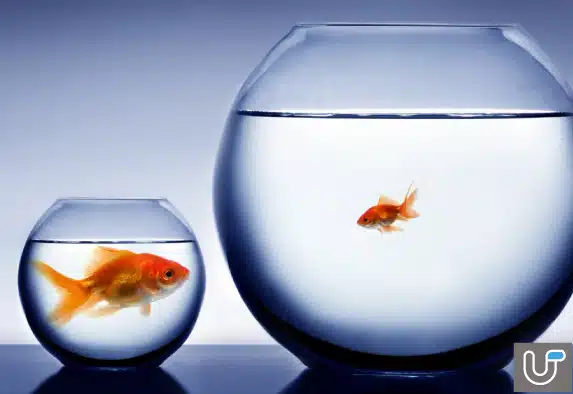

Think of the business line of credit as closer to having a business credit card than taking out a business loan.

It’s because it gives you access to funds you can use to cover all business expenses. You can access funds quickly to manage cash flow challenges, seasonal fluctuations, or seize growth opportunities. Also, the lender will set a specific limit to what you can borrow. Usually, this is determined by business finance, credit history, and business revenue.

There’s no cap on where and how you can use the money, as long as it’s for business purposes. A business line of credit can also be used to support working capital needs, such as covering daily expenses or operational costs.

In terms of benefits, a lender doesn’t allocate a lump sum to your account, which results in monthly payments. Instead, you’re allowed to use a particular sum and repayments.

To clarify, the business line of credit is a revolving line. That means the interest only starts to accumulate when you begin to draw the money. Better yet, you can access the funds again as soon as you cover the credit balance.

But it’s best to put this in context so you understand how the business line of credit works. How does a line of credit operate? It allows you to borrow, repay, and borrow again up to your credit limit, offering ongoing flexibility.

For instance, a lender may approve a line of credit of $80,000. Then, you take out $20,000 to purchase new equipment. Here, you’ll only pay interest on the sum you’ve drawn from the account. You can withdraw funds as needed and only pay interest on the amount you use.

The remaining $60,000 is available to you and you don’t pay interest on that amount. However, you may need to reapply for funds or credit extensions even if you haven’t accessed the full credit limit.

So, if you need an additional $30,000 to expand your business, you can get those funds even before you’ve paid off the $20,000 you already took out. And again, the lender will only charge the interest on the amount you’ve withdrawn.

When comparing a business line of credit to a business loan, a business loan provides a fixed amount or lump sum upfront, while a line of credit offers more flexibility. A term loan is a type of business financing where you receive a lump sum disbursal and repay it over a fixed repayment schedule, making it suitable for large, one-time expenses. With a term loan, interest is calculated on the total loan amount, regardless of how much is used.

Still, you should know that unsecured business loan rates may vary from one lender to another. If you’re also considering secured business loans, it’s important to understand how they work and if they’re worth the risk.

How Does a Business Line of Credit Compare to Other Financing Options?

A business line of credit stands out among business finance options due to its flexibility and convenience. Unlike a traditional small business loan, which provides a lump sum upfront that must be repaid over a fixed period, a business line of credit allows you to draw funds as needed, up to your approved credit limit. This makes it an ideal solution for managing cash flow gaps, covering unexpected expenses, or funding growth initiatives like purchasing inventory or buying equipment. Compared to business credit cards, business lines of credit typically offer lower interest rates and higher credit limits, making them more cost-effective for ongoing business needs. While a business loan is best for one-time, large expenses, a business line of credit gives your business ongoing access to funds, so you can respond quickly to opportunities or challenges as they arise. This flexibility makes business lines of credit a preferred choice for many small businesses looking to maintain a healthy cash flow and support their growth.

The Benefits of a Business Line of Credit

The advantages of a business line of credit are significant for businesses aiming to manage cash flow and maintain financial stability. One of the main benefits is the ability to draw funds only when needed, which helps businesses cover operational expenses, bridge cash flow gaps, or seize new opportunities without taking on unnecessary debt. A business line of credit acts as a financial safety net, giving you peace of mind when facing unexpected expenses or market changes. With variable interest rates that are often lower than those of small business loans or business credit cards, businesses can reduce their overall interest costs. Additionally, responsible use of a business line of credit can improve your business’s credit profile, making it easier to access more funding in the future. By having this flexible line of credit, businesses can better manage their finances, respond to challenges, and support ongoing growth.

How Does a Business Line of Credit Work?

A business line of credit works by giving your business access to a predetermined amount of funds, known as your credit limit. You can draw funds from this line of credit whenever you need, and you only pay interest on the amount you actually use—not the entire credit limit. The credit line is often revolving, which means that as you repay the borrowed amount, those funds become available to withdraw again. This setup is especially useful for businesses with fluctuating cash flow, seasonal changes, or ongoing growth initiatives. To gain access to a business line of credit, you’ll typically need to apply with a lender, providing financial information and, in some cases, collateral. The lender will assess your business’s financial health to determine your credit limit and terms. This revolving access to funding makes a business line of credit an ideal solution for businesses that need flexibility and ongoing support.

Getting the Business Line of Credit

The submission and approval process isn’t that different to other small unsecured business loans

That is, the lenders will typically ask you to provide balance sheets, bank statements, and income statements. Additionally, they will check your business credit history. It’s also not uncommon for some lenders (banks particularly) to check your personal credit history as well.

More importantly, some lenders might refuse you if your company has been reporting losses in previous years. So, the rule is that it’s best to show the lender that your company has been earning money.

Assuming you have a stable business and a good credit history, it’s best to apply for the business line of credit sooner rather than later. Maintaining good standing with the lender is important for continued access to the line of credit, as it demonstrates your creditworthiness and reliability.

Why?

You want to apply when your business is healthy and has a stable cash flow. That increases your likelihood of getting approved, and the funds will be available when you need them the most.

That being said, some lenders may set a timeframe to access the funds before your business needs to undergo another approval. This is part of the contract terms and conditions, and you surely need to ask the lender about it before applying.

Now, there are also certain things regarding keeping the loan.

To keep the loan, the lender may demand that your business remains above a specific level of debt. Commonly, this is based on your current debt, revenue, and borrowing capacity. Some lenders may require collateral for secured lines of credit, such as inventory, equipment, or real estate, which can help you qualify for better interest rates or higher credit limits.

Also, the lender may require you to cover the entire amount you take out within a predetermined timeframe. The lender will set specific repayment terms, including interest rates, repayment schedule, and any applicable fees, so you know exactly what is expected for responsible debt management. Or your business may need to keep a particular net worth.

Fees and Interest: What to Expect

When you use a business line of credit, you’ll pay interest only on the funds you draw, not on your total credit limit. The interest rate you receive will depend on your business’s creditworthiness and the lender’s terms, but it’s often lower than rates for small business loans or business credit cards. In addition to interest, there may be other fees associated with your line of credit, such as origination fees, maintenance fees, or draw fees. These fees can vary by lender and by the specific credit line you choose. It’s important to carefully review all terms and conditions so you understand the total cost of borrowing. By being aware of the interest rates and fees, you can make informed decisions about how to use your business line of credit to manage cash flow and fund your business operations efficiently.

Are There Any Risks?

If you use the business line of credit to improve your cash flow and grow the business, the risk is low.

However, this doesn’t mean you should rely heavily on it.

It’s okay to use the line of credit to cover payroll when necessary, and you can also use it to cover some short-term losses. But if you keep resorting to fast unsecured business loans to pay for the expenses of running your business, that may signal a much bigger problem.

Companies that do it often struggle to secure a stable cash flow each month, which shows there’s something wrong with their operations or business model. But even that situation is repairable.

Should your business find itself in a similar pickle, you might need to consider a more long-term financing solution with lower interest rates.

Lastly, note that there are secured and unsecured business lines of credit. Unsecured lines of credit typically come with higher interest rates because they do not require collateral.

With unsecured, you’ll be required to pledge an asset to provide the lender with collateral. Should you choose the unsecured route, the lenders may ask for a personal guarantee or lien.

Either way, keep in mind that a lender will first check your finance and credit history. And if that’s in order, you should be able to negotiate more favourable terms and conditions.

Using Your Business Line of Credit Responsibly

To get the most out of your business line of credit, it’s important to use it responsibly. Only draw funds when necessary, and make sure to repay them on time to avoid accumulating unnecessary debt and fees. Keep a close eye on your credit limit, interest rate, and any associated fees, so you always know where your business stands financially. Prioritize using your credit line for essential expenses or growth initiatives that will benefit your business in the long run. By managing your business line of credit effectively, you can reduce interest costs, maintain strong financial health, and build a positive credit history. Regularly reviewing your credit line and adjusting your usage as your business needs change will help ensure that your line of credit continues to support your goals.

Business Line of Credit and Business Growth

A business line of credit can be a key driver of business growth, providing the necessary capital to take advantage of new opportunities or expand your operations. With access to a flexible credit line, your business can quickly respond to market changes, invest in a marketing campaign, purchase additional inventory, or cover increased operational expenses. This financial cushion helps you manage the risks that come with growth, such as higher inventory costs or the need to buy new equipment. By using your business line of credit strategically, you can fund important initiatives, support your team, and position your business for long-term success. Whether you’re looking to scale up, launch a new product, or simply ensure you have the resources to meet demand, a business line of credit gives you the access to funding you need to grow with confidence.

Get Your Line of Credit Now

Whichever way you look at it, the business line of credit is among the best unsecured business loans Australia has to offer.

Sure, you need to show the lender that your finances are stable. And you might be required to provide a guarantee. But the benefits outweigh the requirements. Credit offers businesses a flexible financing option for managing cash flow, handling seasonal fluctuations, and meeting various operational needs.

Tapping into the funds whenever you need them and paying interest only on what you take out works great for most businesses. With a business line of credit, you can seize opportunities quickly as they arise, helping your business stay competitive and grow.

But if you’re not sure if the business line of credit is the best option, Unsecured Finance Australia is here to assist.

We specialise in unsecured business loans that small business owners can use however they see fit, including covering unexpected expenses or tax debt.

Apply online, and you can receive your approval within 24 hours.

Find out more by taking a look at our unsecured business loans