3 Tips for Managing Seasonal Revenue in a Sales Cycle – Unsecured Finance Australia

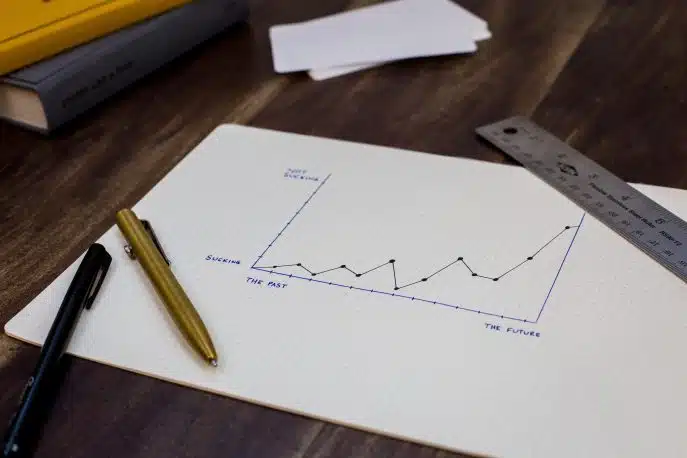

If you own a small business and it stops generating sales for several weeks in a row, what are you going to do about it? This is a question a lot of small business owners find very difficult to answer, particularly those that operate in a seasonal business such as food, hospitality and retail.

Agreed, every business has its ups and downs; there are good months and bad months. Seasonal dips are common and require strategic planning to manage effectively. However, some of the businesses in the food, hospitality and retail industries, including a retail store, tend to rely solely on the good months to fund their operations for the full year. External factors such as holidays, weather conditions, and industry events can significantly impact demand, leading to predictable revenue peaks and dips that affect cash flow management.

Many small business owners find it very difficult to figure out how to meet the challenges of a seasonal sales cycle. Having a comprehensive business plan tailored for a seasonal business is crucial for financial preparedness and long-term success. If you own a small business in such criteria, you already know it’s not easy managing a business with seasonal sales.

Here are 3 tips that can help you:

Make use of Seasonal or Part-time Employees

Letting go of a productive employee is not an easy decision. However, this is necessary sometimes in order to keep the business going. This is particularly true with seasonal businesses like niche clothing shops and some beachfront restaurants that cater for specific seasons.

If you hire a big staff as a result of the increased work that comes with the good months, you need to remember that it’s not a good idea to keep such a large team when things start to slow down. So, it’s much better to hire part-time employees to get you through the busy season. This way, you don’t have to worry about spending too much on employee salaries when business is slow.

Shorten Your Opening Hours

Consider shortening your business operation hours during the slow months or off peak seasons. There is no need to keep the business open at a time when you know that you’ll hardly get any customer. So, it’s better stay open for only a few hours as necessary or close the shop altogether during slow periods.

Why’s that? Well, you’re paying for electricity, gas, and salaries of employees every day you stay open. Why incur all these costs when there are no in-coming customers to offset them? There is no special way of knowing when to stay open and when not to. You have to experiment with a few schedule variations to find out what works for you and your customers.

Look for Additional Streams of Revenue

If your business is customer-driven and you don’t receive customers in particular periods, you may have to consider other revenue sources. As an example, a restaurant that depends heavily on the tourist season for new customers could expand into catering while still catering for tourist customers during the busy seasons.

It’s a challenge for many small businesses to be able to predict future revenues, especially those in seasonal industries. If you’re a small business owner and you operate on a seasonal basis, implementing some or all of the above tips will go a long way in sustaining your business long term.

Implementing the right strategies and navigating seasonal fluctuations can make all the difference in maintaining business stability for your seasonal business.

If you are looking to sustain your business through a quite period and need extra funds to do it, talk to Unsecured Finance Australia about how we can help you meet your business finance needs.

Introduction to Seasonal Fluctuations

Seasonal fluctuations are a reality for many small businesses, especially those in industries like retail, hospitality, and tourism. These fluctuations refer to the predictable patterns of changes in customer demand, sales, and operational activity that occur at certain times throughout the year. For example, a retail store may see a surge in sales during the holiday season, while experiencing slower periods in the months that follow.

Understanding and managing seasonal fluctuations is essential for maintaining financial stability and ensuring your business can cover expenses year-round. By analyzing historical sales data and identifying seasonal trends, you can anticipate when your peak seasons and slow periods will occur. This insight allows you to plan ahead, adjust your business strategy, and implement effective cash flow management practices. With careful planning and a proactive approach, managing seasonal ups and downs becomes much more manageable, helping your business stay resilient and profitable throughout the year.

1. Understand Your Seasonal Fluctuations

For seasonal businesses, understanding your unique seasonal trends is the foundation of effective cash flow management and long-term success. Seasonal trends are the predictable patterns in customer demand, sales, and operational activity that occur throughout the year, often influenced by factors like weather, holidays, and cultural events. By closely analyzing your historical sales data, website traffic, and customer demand, you can identify these patterns and anticipate both peak seasons and slow periods. Expanding into new markets or customer segments can also help manage seasonal demand and generate more consistent revenue throughout the year.

Recognizing when your business experiences revenue peaks and seasonal fluctuations allows you to plan ahead. For example, you can adjust your inventory management to ensure you have enough stock during high demand periods, while avoiding excess inventory and storage costs during off-peak times. This proactive approach also helps you optimize staffing levels, ensuring smooth operations without unnecessary expenses during slower periods.

Additionally, understanding your seasonal trends enables you to create seasonal campaigns by customizing messaging, visuals, and promotional offers around specific seasonal themes to capitalize on trends. By timing your marketing messages and promotions around local and cultural events, you can create buzz and attract customers when it matters most. Ultimately, identifying and responding to these predictable patterns supports steady profitability and financial stability throughout the year, helping your business stay ahead of the competition.

2. Manage Your Cash Flow Proactively

Proactive financial management is essential for seasonal businesses to navigate the ups and downs of seasonal fluctuations and maintain financial stability. Careful planning starts with forecasting demand using historical data and current market trends, allowing you to anticipate cash flow challenges and prepare for slow periods. By setting realistic budgets and building cash reserves during peak season, you create a financial cushion to cover expenses when revenue dips.

To further strengthen your cash flow, consider implementing loyalty programs that encourage repeat customers and steady sales throughout the year. Negotiating flexible payment terms with suppliers can also help you manage outgoing payments during off seasons, reducing financial strain. Timely and efficient service delivery is crucial for accurate invoicing, maintaining customer satisfaction, and supporting effective payment processes. Managing cash flow levels carefully ensures you’re not tying up cash in unsold products, especially during slower periods.

Exploring additional revenue streams, such as offering off season products or services, can help diversify your income and reduce reliance on peak season sales. By taking a proactive approach to financial management, you can minimize the impact of seasonal downturns, cover fixed costs, and maintain a stable financial position year round.

3. Diversify Your Income Streams

Diversifying your income streams is a powerful way for seasonal businesses to maintain steady cash flow and achieve long-term financial stability. Instead of relying solely on peak season revenue, consider expanding your range of products or services to attract customers throughout the year. For example, you might offer off-season discounts, create bundled packages, or introduce new services that appeal to your target audience during slower periods.

Partnering with other local businesses can also open up new opportunities, such as joint promotions or complementary service offerings that draw in more customers. Leveraging social media platforms and creative marketing campaigns helps you create buzz around your business, even during off seasons, and keeps your online presence top-of-mind for potential customers.

By staying attuned to market trends and evolving consumer behavior, you can identify new opportunities and adapt your business strategy accordingly. This approach not only helps you weather seasonal downturns but also positions your business for growth, ensuring you remain competitive and financially stable throughout the year.

Marketing and Customer Engagement

For seasonal businesses, effective marketing and customer engagement can make all the difference in attracting customers and maintaining financial stability throughout the year. By understanding seasonal trends and customer behavior, you can develop marketing strategies that create buzz and drive sales during peak periods. Tailoring your marketing messages to coincide with local events and cultural events helps you reach your target audience when they’re most likely to engage.

Loyalty programs and customer engagement initiatives are especially valuable during slower periods, encouraging repeat customers and helping to smooth out revenue dips. Leveraging social media platforms and email marketing keeps your brand top of mind, even during off-peak periods, and allows you to maintain a strong connection with your customer base. By prioritizing customer engagement and timing your campaigns to match seasonal trends, you can attract customers, build loyalty, and ensure your business remains competitive and financially stable throughout the year.

Inventory and Demand Forecasting

Accurate inventory and demand forecasting are crucial for seasonal businesses looking to manage cash flow and maintain financial stability. By analyzing historical sales data and seasonal trends, you can forecast demand for your products or services and adjust your inventory levels accordingly. This approach helps you avoid overstocking during slow periods, which can tie up cash and increase storage costs, as well as prevent stockouts during peak seasons when customer demand is high.

Effective inventory management also allows you to optimize staffing levels, ensuring you have enough team members to deliver excellent service during busy periods while minimizing unnecessary expenses during slower periods. Leveraging data and analytics gives you valuable insights into customer behavior and market trends, enabling you to make informed decisions that support smooth operations and minimize cash flow challenges. With careful planning and demand forecasting, your business can stay agile and financially stable, no matter the season.

Off-Season Strategies

Developing strong off-season strategies is key for seasonal businesses to maintain financial stability and prepare for the next busy season. Offering off-season discounts, bundled packages, or introducing new services can help attract customers during slower periods and reduce the impact of seasonal fluctuations. Collaborating with other local businesses for joint promotions or community events can also create buzz and drive additional revenue during off-peak periods.

The off season is also an ideal time to focus on growth initiatives, such as staff training, launching new marketing campaigns, or developing new products and services. By using this time strategically, you can strengthen your business, build customer loyalty, and ensure you’re ready to capitalize on opportunities when peak periods return. Prioritizing off-season strategies helps your business stay competitive and financially stable throughout the year.

Conclusion and Final Tips

Successfully managing seasonal revenue requires a proactive approach, careful planning, and a willingness to adapt your business strategy to changing market conditions. By understanding your seasonal trends, engaging customers with targeted marketing, forecasting demand, and implementing effective off-season strategies, you can navigate seasonal fluctuations and maintain financial stability throughout the year.

Remember, building cash reserves during peak seasons, diversifying your income streams, and staying connected with your customers can help you cover expenses and weather any slow period. With the right strategies in place, your seasonal business can thrive year-round. If you need support to bridge cash flow gaps or invest in your next growth opportunity, Unsecured Finance Australia is here to help you achieve your business goals.