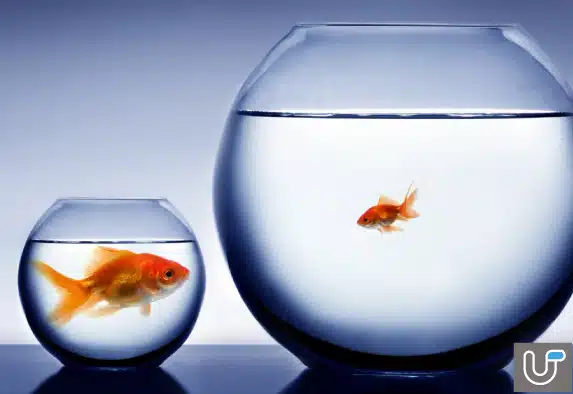

Whilst many of us say that we want to grow our business, making it happen is another.

We’ve all put lots of blood, sweat and tears into our business. We want to maximise the resources invested in our business, but quite often, as business owners, we tend to put new people on last as we push harder and harder to get the most we can from our current employees. Tailored loan solutions are designed to empower customers and enhance their experience, ensuring that customers have access to the right financial tools for their business needs.

But, are we pushing our future chances of success away with this strategy? Likely so, as many businesses require additional headcount to assist with growth… An example of this is a small business owner who does a bit of everything; sales, operations, marketing, finances and much more. If they invest in growth, and take on specialist staff, they can focus on other activities that better use their time and produce more profit for the business.

Yet, many people sit idly watching whilst their competition are on the fast track to success. How? Their competition are considering their future and are thinking big. But just as importantly, they are moving at a fast, rapid rate. Great ideas mean nothing if they are not acted upon. What makes this difference is that other business owners are being proactive in their search for strong business growth.

Using unsecured capital from a business loan provider can help turbo-charge your hiring strategy, where you can use this funding to pay your staff initially, and as your business becomes more profitable, the proceeds can fulfil the requirements of the loan and pay wages. One key advantage of this approach is the quick access to funding, allowing you to seize time-sensitive business opportunities and gain a competitive edge. As they say, having the correct people “on the bus” is critical to business growth.

A failure to care for your employees by pushing them too hard can prove to be costly to a business; they can simply leave (meaning you’ll have to spend considerable time retraining their replacement), or they could suffer issues relating to burn out (ill or mental health issues).

Being aware of your short and long-term growth strategies, and how your organisation will grow is rewarding. Take the time to think big, and if you play your cards right, you may just grow fast. Loan solutions can also be used for personal needs such as purchasing a car, consolidating debts, or investing in education, providing flexibility to support both business and personal goals.

If you use the funds to pay staff, managing your account details, loan balance, and payments through internet banking provides a seamless experience, making it easy to track your money and stay on top of your finances. It’s important to understand all fees, interest rates, loan terms, and the full terms before proceeding with a loan, so you can make informed decisions that benefit your business and personal life.

If you’re looking for an easy to manage loan solution to help set you up for growth, chat to the team at Unsecured Finance Australia about how we can help you with your unsecured business loan needs. Take the first step and contact our team for more information or to discuss your specific needs. Saving and building savings through smart loan management can add value to your business and personal wealth, improving your financial life. Unsecured Finance Australia supports clients in tracking money, managing payments, and planning for future investing or wealth-building goals.

Introduction to Unsecured Finance

Unsecured finance opens the door for individuals and businesses to access funds without the need for collateral, making it a flexible and accessible solution for a wide range of financial needs. At Unsecured Finance Australia, we pride ourselves on offering tailored loan solutions designed to meet the unique needs of every client—whether you’re seeking a personal loan to cover unexpected expenses or commercial loans to invest in your business growth.

Our experienced brokers and dedicated team are here to guide you through every step of the process, from understanding your financial situation to managing loan repayments and selecting the right loan amount. We know that navigating the world of loans can be complex, which is why we provide expert support and clear advice to help you make informed decisions that align with your financial goals.

With a variety of loan options available—including variable rate loans and fixed rate loans—we ensure you have access to the funds you need, when you need them. Whether you’re looking to consolidate debt, invest in your business, or simply manage day-to-day expenses, our tailored solutions are designed to benefit you and help you achieve your objectives. By choosing Unsecured Finance Australia, you gain a partner committed to your success, offering seamless service and support throughout the approval process and beyond.

Loan Options

At Unsecured Finance Australia, we understand that every client’s financial situation is different, which is why we offer a comprehensive range of loan options to suit your unique needs. From home loans and personal loans to commercial loans, our tailored loan solutions are designed to help you manage repayments, achieve your financial goals, and support your business or personal ambitions.

Our loan options are flexible and can be customized to fit your circumstances, whether you’re looking to purchase a new home, invest in your business, or cover unexpected expenses. We offer competitive interest rates, flexible repayment terms, and dedicated support to ensure you can manage your loan repayments with confidence.

Choose from secured and unsecured loans, as well as low-doc and non-conforming loans, to find the right fit for your needs. Our team works closely with you to understand your goals and provide personalized loan options that help you invest in your future, manage expenses, and benefit from expert support every step of the way. With Unsecured Finance Australia, you can be sure you’re getting the best possible solution to achieve your financial objectives.

Home Loans

Securing the right home loan is a major step toward achieving your property dreams, and at Unsecured Finance Australia, we specialize in providing comprehensive home loan services tailored to your needs. Our experienced brokers take the time to understand your financial situation, goals, and circumstances, ensuring you receive a home loan solution that’s right for you.

We offer a wide range of home loan options, including variable rate loans, fixed rate loans, and split loans, so you can choose the structure that best suits your financial circumstances and long-term plans. Whether you’re a first home buyer, an investor, or looking to refinance your existing mortgage, our team provides expert guidance and support throughout the entire process—from application to approval.

Our goal is to help you achieve your dream of owning a home, whether it’s your first property, an investment, or your forever home. With our seamless services, dedicated support, and commitment to your success, you can move forward with confidence, knowing you have a team of experts by your side every step of the way.

Expert Guidance and Support

Navigating the world of finance can be overwhelming, but with Unsecured Finance Australia, you’re never alone. Our team of experienced brokers and dedicated support staff are committed to providing expert guidance and support throughout your loan journey. We take the time to understand your unique needs, financial situation, and goals, offering tailored solutions that empower you to make informed decisions about your finances.

From helping you explore your loan options to managing loan repayments and achieving your financial goals, we’re here to assist you at every stage. Our personalized approach ensures you receive the advice and support you need to consolidate debt, invest in your business, or purchase a new home. We believe in building lasting relationships with our clients, providing ongoing support and expert advice to help you achieve your financial future.

By choosing Unsecured Finance Australia, you benefit from our expertise, commitment to exceptional customer service, and dedication to helping you achieve your goals—no matter where you are on your financial journey.

Loan Application and Approval

At Unsecured Finance Australia, we believe that accessing the funds you need should be a seamless and stress-free experience. Our loan application and approval process is designed with our clients in mind, ensuring efficiency, transparency, and support from start to finish.

From the moment you begin your application, our team is here to guide you through each step, providing clear information and assistance to help you secure the right loan for your needs. We focus on making the process as straightforward as possible, so you can move forward with confidence and access the funds you need to achieve your goals.

With our commitment to exceptional service and client satisfaction, you can trust Unsecured Finance Australia to deliver a positive and rewarding loan experience every time.